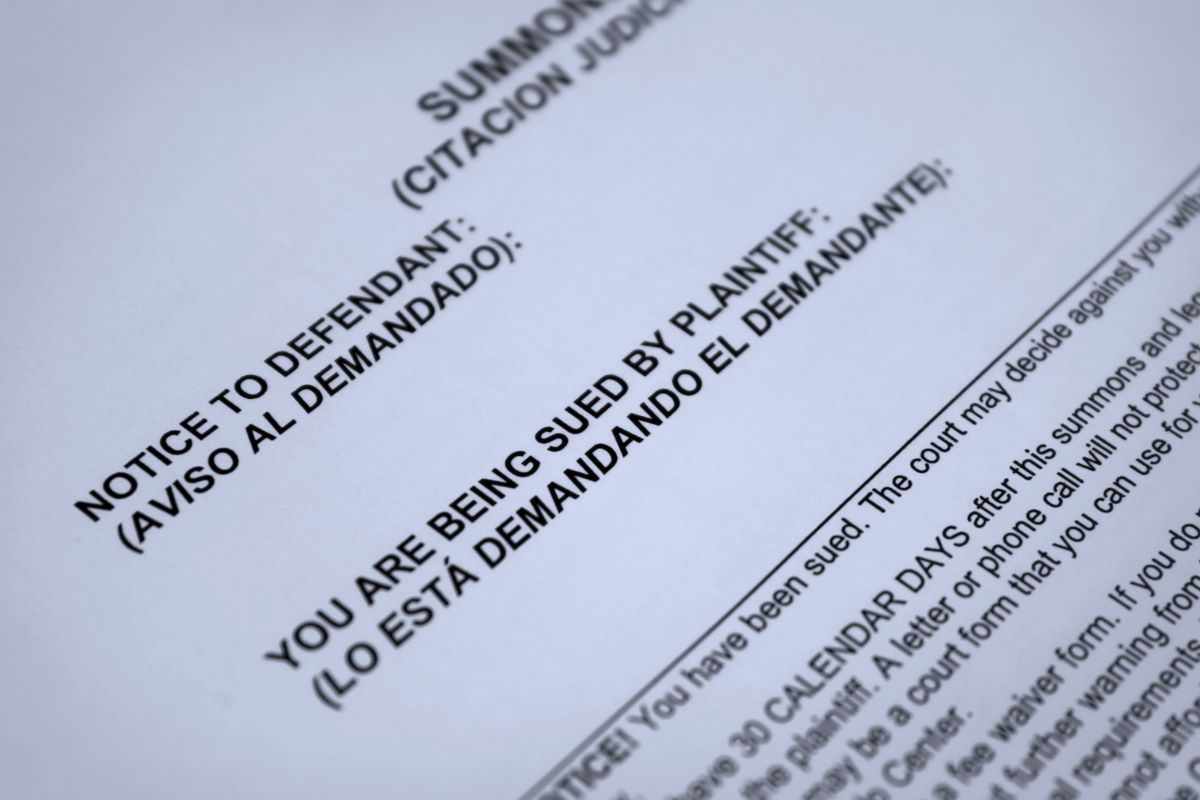

What is a Debt Validation Letter

A debt validation letter is a written request to a debt collector for information about a debt that they claim you owe. Under the Fair Debt Collection Practices Act (FDCPA), you have the right to request verification of a debt before you are required to pay it. In a debt validation letter, you can request … Read more