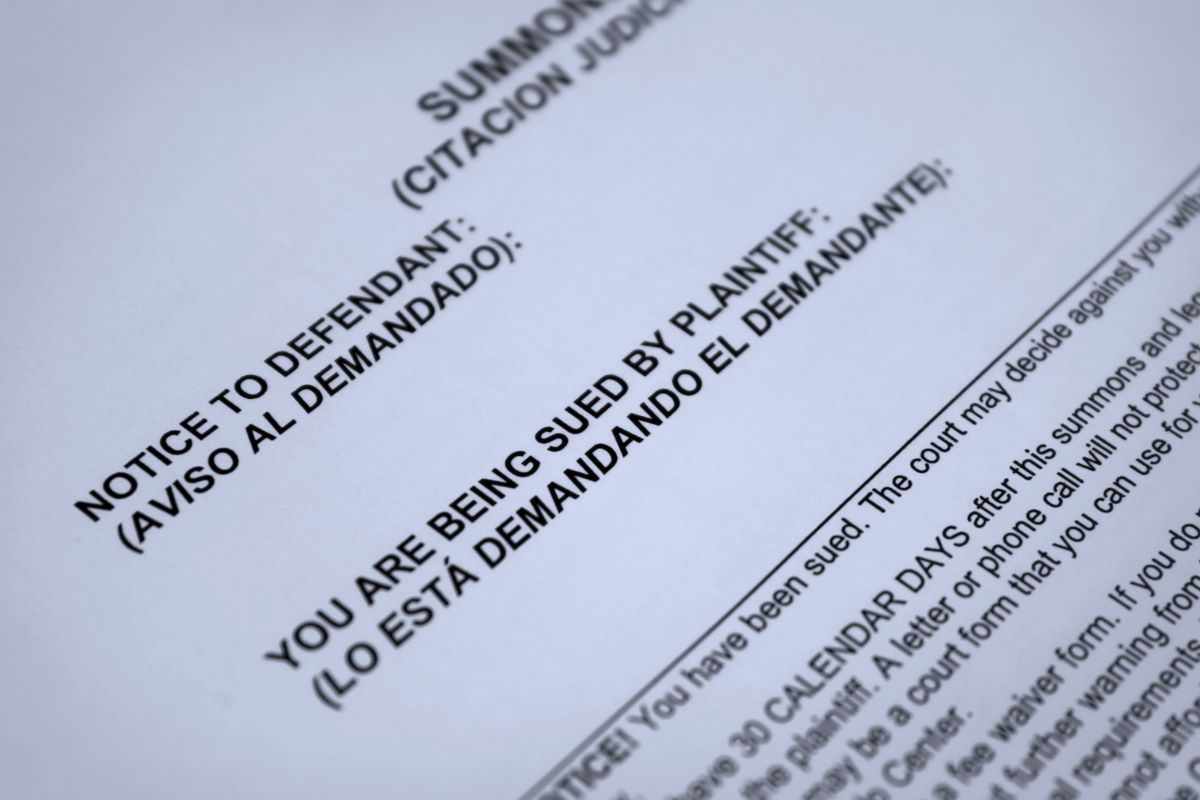

Defending Yourself in Court Against Debt Collectors

Defending yourself in court against debt collectors can be scary and complicated. But it doesn’t have to be hard. Follow a few easy steps and you can answer a civil summons for a credit card debt, medical bill, or other similar collection with confidence. How to answer a summons for debt collection The first step … Read more